Malaysia Epf Calculator For Payroll System Malaysia

Employees’ Provident Fund commonly known by the acronym EPF Johor (kwsp) is a federal statutory body under the purview of the Ministry of Finance. It manages the compulsory savings plan and retirement planning for private sector workers using epf calculator for Payroll System Malaysia.

Membership of the EPF Malaysia is mandatory for Malaysian citizens employed in the private sector, and voluntary for non-Malaysian citizens for payroll system malaysia. As an employee, you are required to contribute to the KWSP under the EPF laws.

This is to ensure that you have some financial security in the payroll system malaysia form of retirement savings when you retire or when you are no longer employed.

EPF Calculator Malaysia Directory

√ Categories of EPF Contribution

√ Condition for EPF Membership

√ Contribution Rate for EPF Calculator

√ Payment Subject For EPF Calculator

√ Retirement Savings For EPF Member

√ EPF Malaysia Branch in Johor

√ Contact Us For Payroll System Malaysia

Who can become EPF Member for EPF Malaysia?

- Directors who receive a salary/wage;

- Full-time, part-time, temporary, moonlighting and probationary employees;

- Employees up to the age of 75 years;

- Employees who have withdrawn their savings under Pensionable Employee Withdrawal, and work with employers other than the federal or state governments, or any statutory bodies or local authorities;

- Employees who have previously made a full withdrawal under Incapacitation Withdrawal and have since recovered and are re-employed in any service for payroll system malaysia.

How to Register as EPF Member for EPF Calculator

- Automatic registration

Once the EPF has received the first contribution from your employer for payroll system malaysia. The registration will be made based on your name and identification card number as stated in Form KWSP 6 (Form A). Account will be activated once the EPF received verification from the National Registration Department (NRD).

- Registration at the counter

Registration using MyKad verification can be made at the nearest EPF branch. In the event of unsuccessful verification or if you are not a Malaysian citizen, you will be required to complete the KWSP 3 (Registration) Form. You will receive a notice with EPF member number upon successful registration.

- Registration through Employer i-Akaun

Employer may register you as an EPF member through Employer i-Akaun, and will be required to key in your details such as full name, MyKad No., gender and other related information correctly. Member will receive a notice with the EPF member number upon successful registration.

- Registration through Kiosk

Need to bring your MyKad to the nearest EPF branch or any premises with the EPF Smart Kiosk to register as a member. MyKad and thumbprint verification will be required to complete registration. Member will receive a notice with the EPF member number upon successful registration.

Categories Not Compulsory But Optional To Contribute Towards KWSP

Malaysian citizens

- If domestic servant employed in a residential home and wages are paid by an individual (the home owner), you may opt to contribute by completing Form KWSP 1 (MAJ). A copy of the form must be submitted to the EPF and another copy to the employer.

- If you are self-employed and wish to contribute voluntarily, you must first register as an EPF member by completing Form KWSP 3. Contribution payments can be made using Form KWSP 6A (1). The contribution amount is subjected to a maximum of RM60, 000 per annum, including the contributions accumulated from voluntary contribution (Government Incentive) and the Top up Savings Contribution.

Non-Malaysian citizens

- If non-Malaysian who is legally employed and staying in Malaysia, you may submit a notice of election to contribute using Form KWSP 16B and register as an EPF member using Form KWSP 3. You must submit a copy of Form KWSP 16B to the EPF and another copy to the employer.

- Election to contribute will, however, cease to take effect after the non-Malaysian citizen has withdrawn all savings (either through Age 55/60 Withdrawal, Leaving the Country Withdrawal, or Incapacitation Withdrawal). If a member chooses to re contribute, a new registration has to be made and will be subjected to terms and conditions.

Condition to End/Stop becoming an EPF Member

EPF membership will end/stop upon these conditions:

- No new contribution after member reached 75 years old with zero balance in account.

- Has made leaving the Country Withdrawal with zero balance in account.

- Account status is Death Withdrawal with zero balance in account.

- Savings have been transferred to the Registrar of Unclaimed Monies.

- Foreigner that has withdrawn 55/60 year Full Withdrawal.

Benefits as an EPF Member for EPF Calculator

- Account 1 Saving Top-Up

Account 1 Saving Top Up is a facility provided by the EPF to increase members’ retirement savings besides upholding family values. Topper may voluntarily make additional contributions to the savings of his/her spouse or family members’ EPF account. Account 1 Saving Top Up is available to those specified below:

| Toppee | Topper |

| EPF or non-EPF member |

Topping up of savings can be made every month at EPF counters, subject to a maximum of RM60, 000.00 per year.

The Claims for Matrimonial Asset enables the EPF to conform to the Court Order for claims of matrimonial assets involving the EPF savings of non-Muslim members.

- Eligibility

- Malaysian citizens or non-Malaysians are eligible to apply.

- Claims of Matrimonial Asset only applies to non-Muslim applicants only.

- Court orders should be submitted together with the application.

- Application of Claim for Matrimonial Asset may be made within six (6) years.

- Withdrawal Conditions

You can make withdrawals for Claims of Matrimonial Asset through the following types of withdrawal:

- Age 55

- Leaving the Country

- Incapacitation

- Death

Required documents:

- KWSP Form AT (2) – Application for Matrimonial Asset Claim

- Identification card

- Passport for Non-Malaysian recipient

- Court Order (Decree Nisi) and Certificate of Making Decree Nisi Absolute

Additional information:

- You or your beneficiary will not be eligible for Disability / Death Benefits if the savings in your account comprise only a Claim of Matrimonial Asset.

- Can make a nomination for the savings of a Claim of Matrimonial Asset.

- Application of Claim of Matrimonial Asset can be made at EPF counter or by mail.

- Retirement Benefit

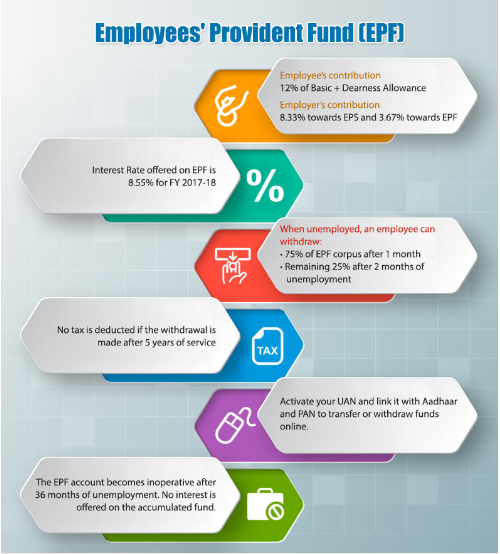

Your EPF savings are meant for your retirement. The savings comprise the employee’s and employer’s shares of the contributions plus the yearly dividends for payroll system malaysia. When you contribute 8% of your monthly salary to the EPF, your employer will contribute another 12% or 13% of your salary (this contribution rate is subject to changes by the government) to your EPF savings. Either you or your employer or both may contribute at a rate exceeding the statutory rates. If you do not contribute, you do not get that additional retirement benefit.

- Dividend

All contributions to the EPF will be paid dividend and guaranteed by the government at a minimum rate of 2.5%.Dividend for every member’s account is calculated based on aggregate daily balance.

- Simpanan Shariah Dividend

Dividend rate declared for Simpanan Shariah accounts will be based on the actual performance of shariah-compliant investments managed and invested by the EPF.

- Incapacitation and Death Benefits

Incapacitation and Death Benefits are a goodwill gesture by the EPF Malaysia, payable to the member/guardian or beneficiary to help lessen the financial burden when the member suffers from incapacitation or in the event of death,money comes from EPF investment earnings and not from the member’s savings in payroll system malaysia.

- Incapacitation Benefit (Incapacitation Withdrawal)

Incapacitation Benefit is paid to the member who has lost his job owing to incapacitation and has made an Incapacitation Withdrawal. Amount for Incapacitation Benefit is RM5, 000.00. This benefit will be given once only, referring to the following conditions:

- Malaysian citizen;

- Member has not attained the age of 55;

- Applied for Incapacitation Withdrawal within 12 months of the date of termination of service;

- Last period of service must be at least 6 continuous months;

- Reason for termination of service must be incapability to work and not disciplinary action or voluntary resignation.

- Incapacitation Benefit (Incapacitation Withdrawal)

Incapacitation Benefit is paid to the member who has lost his job owing to incapacitation and has made an Incapacitation Withdrawal. Amount for Incapacitation Benefit is RM5, 000.00. This benefit will be given once only, referring to the following conditions:

- Malaysian citizen;

- Member has not attained the age of 55;

- Applied for Incapacitation Withdrawal within 12 months of the date of termination of service;

- Last period of service must be at least 6 continuous months;

- Reason for termination of service must be incapability to work and not disciplinary action or voluntary resignation.

- Death Benefit (Death Withdrawal)

Death Benefit is paid to the member’s dependant or next-of-kin, based to consideration by the EPF, when the application for Death Withdrawal is made. Amount for Death Benefit is RM2, 500.00. This benefit will be given once only, referring to the following conditions:

- Malaysian citizen;

- Member has not attained the age of 60 years at the time of death;

- Application for Death Withdrawal is made within 6 months of the date of demise of the member.

- Tax Exemption

EPF Malaysia contributions are tax deductible up to a maximum amount of RM6, 000.00 for the past year and RM4, 000.00 starting this year, subject to periodic amendments by the government (inclusive of exemption for life insurance premium). You are exempted from paying income tax for money withdrawn under the EPF savings withdrawal schemes. Returns on the EPF Malaysia investment are also tax exempted.

EPF Contribution Rate For EPF Calculator Payroll Malaysia

The employees monthly statutory contribution rates will be reverted from current 8% to the original 11% for employees below age 60 and from 4% to 5.5% for those age 60 and above, effective January 2018 wage/salary. The latest contribution rates for employees and employers can be referred at the contribution rate table of. Employers are to remit the employees’ contribution share based on this schedule.

Employees Provident Fund (EPF) announces that the minimum Employers’ share of EPF statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four (4) per cent per month, while the Employees’ share of contribution rate will be zero per cent.

The new minimum statutory rates will start with the January 2019 salary/wage for contribution month of February 2019. The move to reduce the statutory contribution rates follows the Government’s proposal during the tabling of Budget 2019 on 2 November 2018, to help increase the take-home pay for employees who continue to work after reaching age 60.

The reduction in employers’ share to minimum four (4) per cent would also encourage employment opportunities for workers above 60 years of age, thus ensuring the population above 60-years-old to remain productive and active in the economy.

EPF Contribution For Epf Calculator Payroll Malaysia

EPF Malaysia contributions of an employee are made up of the employee’s and employer’s share. EPF Malaysia contributions can be paid by:

- Cash

- Postal order

- Cheque

- Internet banking

- Electronic fund transfer (EFT)

- Bank draft

- Any other channel approved by the EPF

Payment Subject for EPF Contribution in Epf Calculator Payroll Malaysia

- Salary

- Payment for unutilised annual or medical leave

- Bonus

- Allowance

- Commission

- Incentive

- Arrears of wages

- Wages for maternity leave

- Wages for study leave

- Wages for half day leave

- Other payments under services contract or otherwise

Payments Not Subject For EPF Contribution in Payroll System Malaysia

Epf Calculator For Payroll System in Johor Malaysia

It’s always good to start saving for your retirement once you begin to earn a monthly salary. Save regularly to grow your retirement savings.

This is an example for epf calculator to find out how much your salary will need to be save for your retirement.

Example Of Epf Calculator:

Basic Salary : RM3,000

Allowance : RM500

EPF Wages : RM3,000 + RM500 = RM3,500

EPF Employee Contribution : RM3,500 x 11% = RM385

EPF Employer Contribution : RM3,500 x 13% = RM455

Example Of Epf Calculator:

Basic Salary : RM3,700

Bonus : RM3,000

EPF Wages : RM3,700 + RM3,000 = RM6,700.

EPF Employee Contribution : RM6,700 x 11% = RM737

EPF Employer Contribution : RM6,700 x 12% = RM804

EPF Johor Branch for EPF Malaysia

EPF Johor Bahru

Office Tingkat 1, Bangunan KWSP, Jalan Dato’ Dalam 80000 Johor Bahru Johor

Fax No. : 07-2225284

EPF Kluang Office

EPF Muar Office

EPF Batu Pahat Office

Contact Us For More Details on Payroll System Malaysia

We specialized in smart systems such as HR Software Malaysia and Singapore, Time and Attendance Management System (TMS) which able to integrated with variety of Biometrics Devices including Fingerprint, facial and handpunch. We also provide latest BCA EPSS Biometrics Authentication System (BAS) for Singapore BCA ePSS Submission. Others system including, Access Control Solutions, Project Costing Solutions, HR Solutions, Worker Dormitory System, Hostel Billing Managment System, Visitor Management System (VMS), and Cloud based Time Attendance System for multi-chain solutions.

Smart Touch Technology Sdn Bhd

Address: 36-02 & 36-03, Jalan Permas 10, Bandar Baru Permas Jaya, 81750 Masai, Johor, Malaysia.

Contact Number: +607-388 9903

For More Details, please click HERE.

Package Price For Payroll System Malaysia

Smart Touch Technology “STT” is software, hardware & consultancy company. “STT” is specialized in the field of software development, system integration, implementation, systems support, and marketing of “STT” applications in one single database solution. “STT” has developed programs such as HR Software Malaysia, SmarTime (Time & Attendance Systems), Job Costing System, Leave Management System, ID Badges Card System, Security & Access Control System and Visitor Management System.

“STT” is involved in installing numerous systems in both Singapore & Malaysia. “STT” software applications come with standard or customized (according to customers’ specifiction) solutions. The objective of the software design is to offer a flexible user-friendly software that is easy to implement, modify and upgrade.

Click HERE for more Pricing Details >> Package Price