New contribution rate for Malaysia EPF Calculator 2022 for payroll Malaysia.

Employees’ Provident Fund (Malaysia EPF) is a federal statutory body under the purview of the Ministry of Finance. Employees Provident Fund (EPF) will allow education withdrawals for professional certificate programmes under Budget 2022. Every company is required to contribute EPF Calculator for its staff/workers and to remit the contribution sum to KWSP before the 15th day of the following month for salary in Malaysia.

Finance Minister Lim Guan Eng said in an effort to promote adult learning, EPF will expand its scope to allow education withdrawals at the certificate level for accredited programmes.

Malaysia EPF Responds To Budget 2022

The response to the Budget announcements related to the EPF are as follows:

- Malaysians@Work (#MalaysiaKerja)

“Malaysians@Work is an important measure towards resolving critical talent issues in the country, such as low wages and high youth unemployment especially amongst new graduates as well as enabling a return to work programme for women.

The implementation of Malaysians@Work will also ensure the beneficiaries to have their future retirement needs be taken care of as the incentives will be delivered via EPF channels.

- Expansion of Education Withdrawal

Allows EPF members to make withdrawals to fund their education from the certificate level onwards, was made in view of the need to quickly up-skill Malaysians with new competencies and skillsets to address the demands of a changing workforce environment.

- Social Security Coverage for all Malaysians

To address this matter, the EPF is looking to extend EPF coverage to this under-served segment

- Contribution Programme for Spouses

EPF provides an avenue for husbands to voluntarily transfer 2 per cent out of the minimum 11 per cent monthly EPF contribution into their wives’ EPF accounts.

- Withdrawal for Subfertility treatment

Taking note of this, the EPF will be creating a new option under Account 2 for withdrawals for subfertility treatments.

How Malaysia EPF works for 2022?

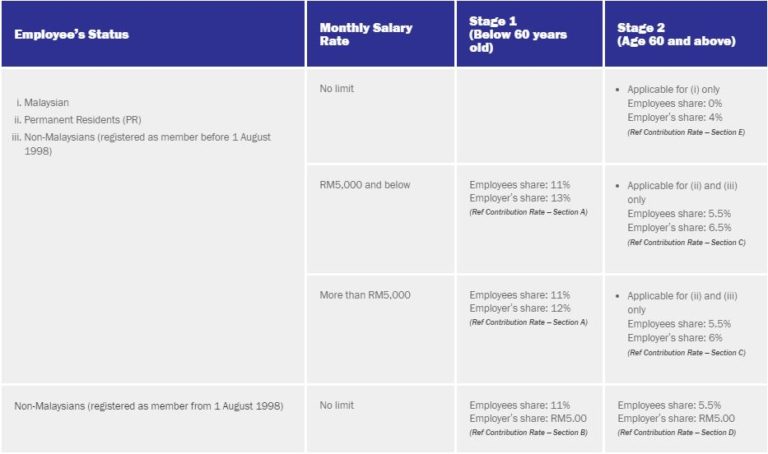

Under EPF scheme, an employee has to pay a certain contribution towards the scheme and an equal contribution is paid by the employer

- For employees who receive wages/salary of RM5,000 and below, the portion of employee’s contribution is 11% of their monthly salary

- Employer contributes 13%

- Employees who receive wages/salary exceeding RM5, 000 the employee’s contribution of 11% remains, while the employer’s contribution is 12%.

- Minimum Employers’ share of EPF statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to 4% per month, while the Employees’ share of contribution rate will be 0%.

Contribution Rate for Epf Malaysia

Calculation of EPF Calculator Malaysia 2022

Example of EPF Calculator (Wages <= 5000):

Basic Salary : RM4, 000

Allowance : RM300

EPF Wages : RM4, 000 + RM300 = RM4, 300

EPF Employee Contribution

: RM4, 300 x 11% = RM473

EPF Employer Contribution

: RM4, 300 x 13% = RM559

Example of EPF Calculator (Wages >= 5000):

Basic Salary : RM4, 700

Bonus : RM3, 900

EPF Wages : RM4, 700 + RM3, 900 = RM8, 600.

EPF Employee Contribution

: RM4, 300 x 11% = RM473

EPF Employer Contribution

: RM8, 600 x 12% = RM1032

Example of EPF Calculator (Age >= 60):

Basic Salary : RM2, 700

Allowance : RM300

EPF Wages : RM2, 700 + RM300 = RM3, 000.

EPF Employee Contribution

: RM3, 000 x 0% = RM0

EPF Employer Contribution

: RM3, 000 x 4% = RM120

Wages or Salary Payment Subject to Malaysia EPF Contribution

Wages Subject To EPF Contribution:

All payments which are meant to be wages are accountable in your monthly contribution amount calculation. These include:

- Salary

- Payment for unutilised Annual or Medical leave

- Bonus

- Allowance

- Commission

- Incentive

- Arrears of wages

- Wages for maternity leave

- Wages for study leave

- Wages for half day leave

- Other payments under services contract or otherwise

Wages NOT subject to EPF contribution:

Among the payments that are exempted from EPF contribution:

- Service charge – a service fee, a tip or other payments which has been paid by, charged on, collected from or voluntarily given by a customer or any other person

- Overtime – Any payment due from an employer to an employee for work carried out in excess of the normal working hours of such employee and includes any payment paid to an employee for work carried out on public holidays and rest days.

- Gratuity – Any payment paid by an employer to an employee upon completion of service or voluntary resignation as a recognition of such employee’s service.

- Retirement benefit – Any payment paid to an employee upon retirement either compulsory or optional or on medical grounds as stated under the contract of service of the employee.

- Retrenchment, temporary lay-off or termination benefits – Any payment paid by an employer to an employee as a result of the employee’s retrenchment, lay-off or termination exercise.

- Any traveling allowance or the value of any travel concession – Any payment paid by an employer to an employee for the purpose of travelling and transport expenses.

- Payment in lieu of notice of termination of service – Amount paid by the employer or employee in lieu of a notice of termination of service by the employer to the employee to terminate his/her services or the employee to the employer upon resignation.

- Director’s fee – Fee paid to the director.